How to Use a Trust Bank Account for Regular Income (and Why Some Families Do It)

At Mike Massey Law, we often get asked:

“Can I use a trust to create regular monthly income, even if it’s technically my own money?”

The answer? Sometimes yes—and some families use this method for very specific financial goals.

One common situation involves setting up monthly distributions from a trust to show lenders a track record of consistent income. This can sometimes help when qualifying for a mortgage, car loan, or other major financial transaction.

Let’s break down how this strategy works.

Example of How It Works:

Here’s a typical scenario:

1. Create a Living Trust if you don’t have one

Mike Massey Law can help you create a revocable living trust (AKA Family Trust, RLT, Living Trust).

2. Open a bank account in the name of your living trust

Open a bank account in person or online at the bank of your choice, in the name of your trust.

3. Transfer a Lump Sum into the Trust

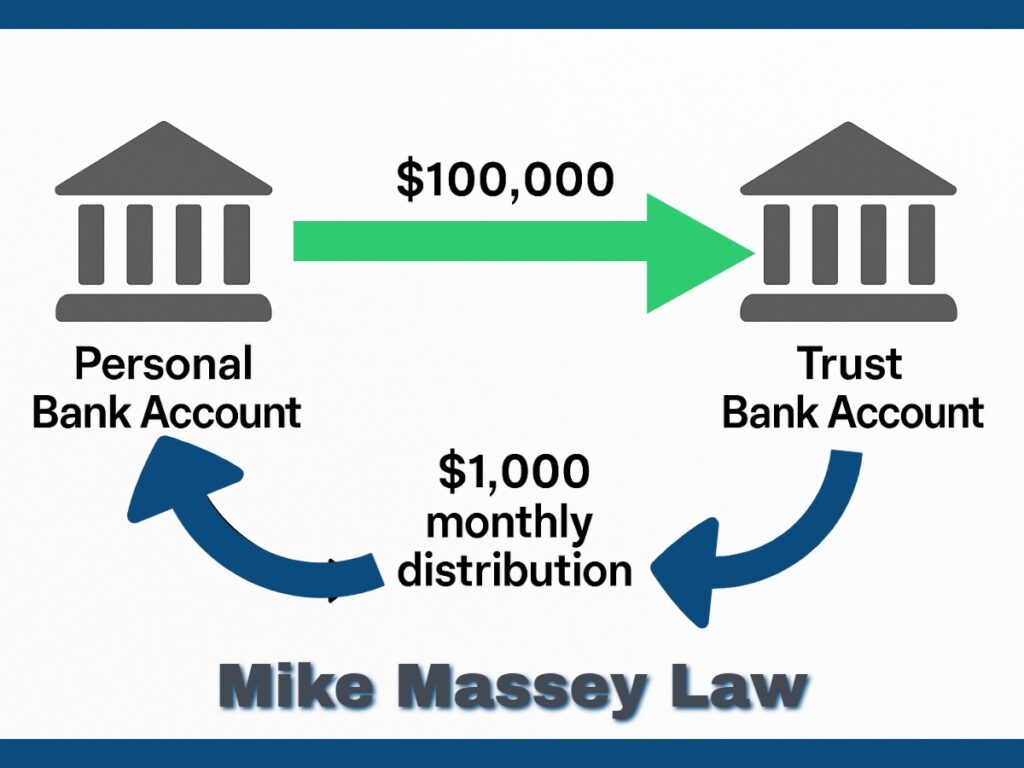

You move $100,000 (as an example, but you decide the amount) from your personal bank account into a Trust Bank Account.

4. Set Up Monthly Distributions

You (assuming you’re the trustee, which is very typical) set up the trust to send $1,000 per month (as an example, but you decide the amount) back into your personal account as scheduled income from your trust bank account into your personal bank account.

5. Create a Consistent Deposit History

Over time, this creates a paper trail of recurring income, which some lenders like to see during underwriting.

Why Would Someone Do This?

Many lenders want to see predictable, consistent income before approving a loan. If most of your wealth is in investments or savings, a trust distribution can mimic a steady paycheck.

This strategy may:

Help establish a pattern of income deposits

Present your financials in a way that fits a lender’s guidelines

Offer more control over how and when your funds are used

Important Disclaimer

Every lender is different.

Some mortgage companies may count trust distributions as qualifying income—but others may not.

There is no guarantee that setting up a trust with monthly payments will help you get a loan. Always check with your mortgage broker or lender first to confirm their requirements.

Things to Consider Before Using This Strategy

Before moving forward, think about these factors:

✅ Trust Structure

Your trust documents must explicitly allow for scheduled or discretionary distributions.

✅ Tax Implications

Trust distributions can trigger tax consequences depending on how the trust is set up.

✅ Lender Requirements

Make sure your lender will accept trust distributions as income before you initiate the process.

✅ Documentation

You’ll need clear, consistent records showing the source of funds and distribution pattern.

How Mike Massey Law Can Help

At Mike Massey Law, we help Texas families:

Set up living trusts and family trusts

Align estate plans with financial goals

Avoid common pitfalls with trust administration

Whether you need help creating a trust for asset protection, family planning, or financial structuring, our team is here to guide you.

Ready to Talk?

Contact us today for a consultation to see if this strategy fits your situation. We’ll help you avoid costly mistakes and structure your estate plan the right way.

📞 Schedule Your Consultation Now:

Disclaimer:

This article is for informational purposes only and does not constitute legal, financial, or tax advice. Establishing a trust and setting up income distributions involves complex legal and financial considerations. Results will vary depending on individual circumstances, lender requirements, and tax implications. You should consult with a qualified attorney, tax professional, and financial advisor before making any decisions. Contacting Mike Massey Law does not create an attorney-client relationship unless a formal agreement is signed.