🧱 Can I Use a Series LLC to Separate My Real Estate and My Operating Business?

By Mike Massey Law, PLLC – Strategic Legal Structuring for Texas Investors

Yes, you can. And if you’re a Texas real estate investor looking to keep your liability watertight, this approach might be perfect for you.

With a Series LLC, you can use one “child” series to operate the business (collect rents, pay contractors, manage repairs)—and another to hold title to your real estate.

Let’s break down exactly how this works—and why so many investors are structuring it this way.

🔧 How It Works: Separate Ownership from Operations

You create a Series LLC, then form two (or more) “child” LLCs under it:

| Series Name | Purpose |

|---|---|

| Series A (HoldCo) | Owns the real estate titles |

| Series B (OpCo) | Manages property operations: leases, maintenance, vendor contracts, and receives rent |

The OpCo leases the property from HoldCo, often under a triple-net lease (NNN), and then subleases to tenants. All operational liabilities are kept in Series B, leaving Series A protected.

✅ Pros of Using a Separate OpCo + HoldCo Structure:

Liability Isolation

If someone sues over a slip-and-fall or contractor issue, they’re suing Series B, not the entity that owns the property.Asset Protection

Your real estate—the valuable asset—is held separately from the day-to-day risks.Easier to Sell or Refinance

If you want to sell or transfer the property, you don’t disrupt your operating business—or vice versa.Cleaner Books

Easier to track income, expenses, and liabilities per series for accounting and tax prep.

❌ Cons and Risks to Consider:

Complexity

More moving parts. You need to maintain separate books, bank accounts, and records for each series.Not universally recognized

If you operate or own property outside of Texas, some states may not honor the series liability protection.Tax strategy must be clear

You’ll need an accountant familiar with Series LLC structures (especially for pass-through tax treatment).Bank and lender confusion

Not all institutions understand Series LLCs—be prepared to educate or use specific banks that “get it.”

🛠️ Step-by-Step: How to Structure It

Form your Series LLC

File the parent entity with the Texas Secretary of State, making it clear it is a “Series LLC.”Create Series A (HoldCo)

Draft a Certificate of Assumed Name for Series A (can use something like “123 Main Street Series”). This entity will:Hold title to the property

Be passive (no employees or operations)

Create Series B (OpCo)

Draft a separate Assumed Name for Series B. This entity will:Sign lease agreements

Manage vendors and property tasks

Collect rent

Draft a Lease Agreement from Series A to Series B

Usually a triple-net lease, where Series B is responsible for taxes, insurance, maintenance, etc.Open separate bank accounts for each series

Keep finances strictly separated to preserve the legal wall between them.Inform insurance and legal advisors

Work with your insurance agent. Typically people put the commercial insurance policy under Series B, with Series A listed as the property owner/loss payee.Reflect ownership and management in your estate plan

Be sure your trust or succession documents account for each series and who will control/manage them after your death or incapacity.

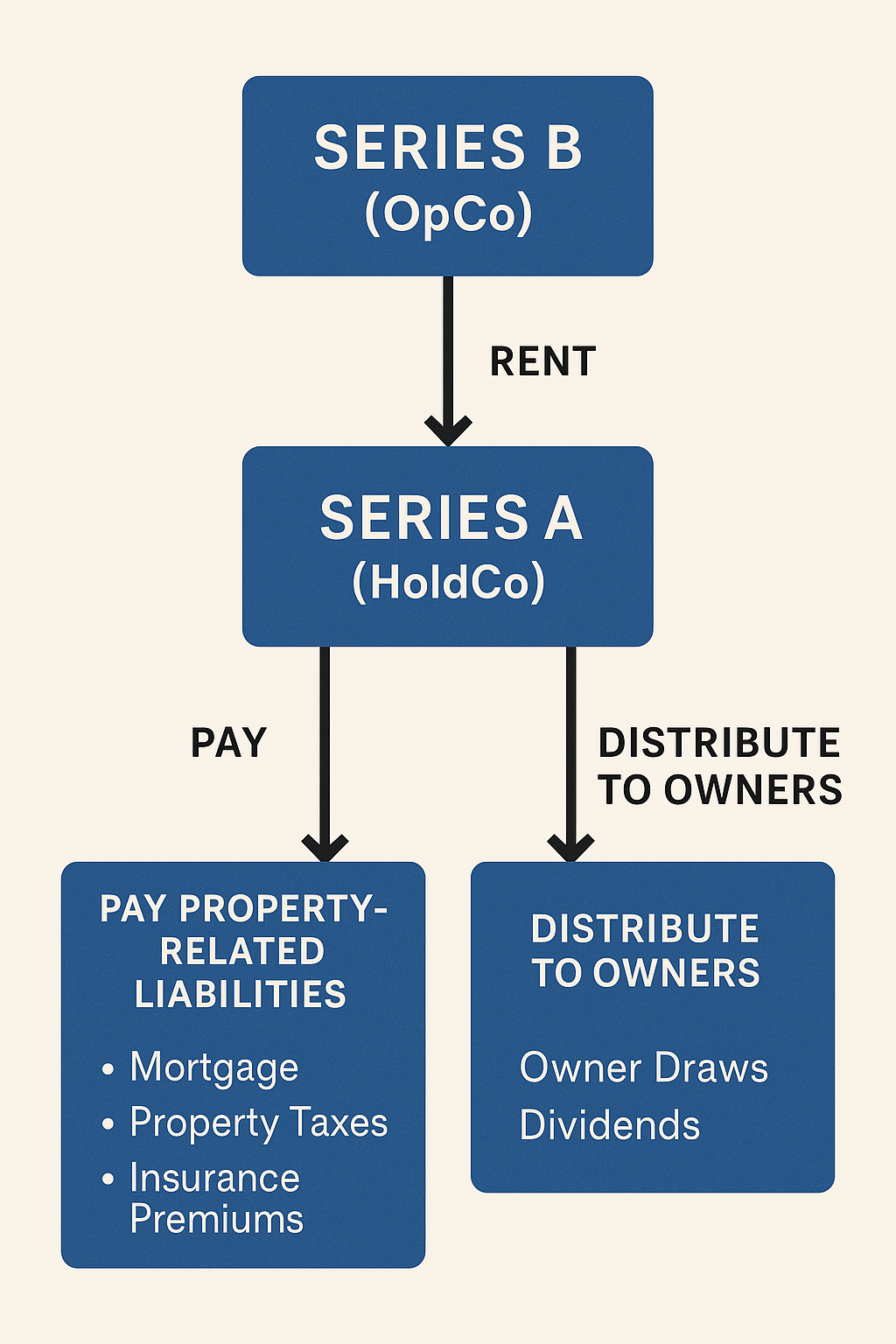

💸 FLOW OF MONEY: SERIES A & SERIES B

🔁 Step-by-Step Breakdown

| Step | Who Does It | What Happens |

|---|---|---|

| 1️⃣ | Series A (HoldCo) | Owns title to the rental property. It leases the property to Series B. |

| 2️⃣ | Lease Agreement | Series B signs a triple-net lease (NNN) with Series A. This lease governs the relationship. |

| 3️⃣ | Series B (OpCo) | Operates the property: markets, manages tenants, collects rent, pays expenses. |

| 4️⃣ | Rent Payment | Series B pays monthly rent to Series A (typically at fair market value or as agreed). This is usually a fixed internal transfer. |

| 5️⃣ | Tenants | Pay rent directly to Series B. |

| 6️⃣ | Series B | Pays for repairs, utilities, taxes, and insurance premiums. |

| 7️⃣ | Series A | Receives rental income from Series B, but does not interact with tenants or vendors directly. Pure holding entity. |

🧾 INSURANCE: WHO HOLDS THE POLICY?

🔐 General Rule: Series B (OpCo) holds the policy.

Why? Because Series B is responsible for daily operations and risks.

| Insurance Type | Held By | Additional Insured? |

|---|---|---|

| Property/Landlord Insurance | Series B (OpCo) | Series A (HoldCo) listed as “Additional Insured” or “Loss Payee” |

| General Liability Insurance | Series B | (Same – name Series A if required) |

💥 CLAIMS & PAYOUTS

If a tenant slips, or a fire occurs:

Claim filed by Series B, since it’s the one managing and interfacing with tenants and vendors.

Payouts may be made to:

Series B (if it’s an operating issue or liability claim)

Series A (if it involves property damage or rebuilding value)

Often both are listed, and proceeds are distributed according to the policy and lease terms.

💡 Important: Insurers must know both Series A and B exist, and must reflect both in the policy documentation. Otherwise, one could be left unprotected in a payout or denied coverage.

💡 ACCOUNTING & TAX TIP

Series A reports passive rental income received from Series B.

Series B deducts that rent as a business expense.

Maintain clean books, separate accounts, and intra-entity lease documentation.

📌 Pro Tip

The clearer and more formalized the arrangement (lease, insurance, accounting, roles), the more likely a judge and insurer will honor the liability firewall between the child series. This also helps the IRS accept separate tax treatment if elected.

🏠 What Does Series A (HoldCo) Do With Lease Payments From Series B (OpCo)?

💰 Step-by-Step: Series A’s Role With Lease Income

When Series A receives monthly lease payments from Series B, it typically uses the funds in this order:

Pay Property-Related Liabilities (if any):

Mortgage (principal + interest)

Property taxes (if not paid directly by Series B in a true NNN lease)

Insurance premiums (only if Series A holds the property policy — rare but possible)

HOA fees or maintenance reserves (if retained at the ownership level)

Distribute Remaining Income to Members (the LLC owners):

This is passive rental income, and it can be distributed as:

Guaranteed payments

Owner draws

Or dividends (depending on tax election—usually disregarded entity or partnership)

Retain Earnings (optional):

If the LLC wants to build a reserve (for major repairs or capital improvements), Series A can hold funds back.

🏦 What If There’s a Mortgage?

Yes — the mortgage must stay with the entity that holds title, which in this case is Series A (HoldCo).

That means:

The loan is legally tied to Series A.

The mortgage lender is expecting Series A to make payments, not Series B.

Series B pays rent to Series A, and Series A uses that rent to pay the mortgage.

✅ This keeps the asset-liability structure clean:

Series A = owns asset + carries debt

Series B = handles operations + risk

📄 Best Practices if a Mortgage Exists:

Be sure Series A is the named borrower on the loan docs.

Use an internal lease agreement that sets Series B’s rent high enough to cover mortgage + overhead + return to ownership.

If Series B ever stops paying, Series A still owes the bank, so maintaining reserves in Series A may be smart.

🚩 Watch Out For:

Comingling funds between A and B (must stay separate!)

Having Series B pay the mortgage directly—this can undermine the legal separation unless it’s treated as a reimbursement or agent payment

If refinancing or buying, make sure the lender understands the Series LLC structure, or you may have to temporarily title in the parent or Series A’s name alone

💬 Summary Chart:

| Series A (HoldCo) | Series B (OpCo) |

|---|---|

| Owns the real estate | Manages operations (leases, rent collection) |

| Collects rent from B | Pays rent to A under lease |

| Pays mortgage, taxes, distributes cash to owners | Handles day-to-day liabilities and insurance |

| Passive income and less liability exposure | Active income and operational liability |

📅 Need Help Structuring It the Right Way?

We help Texas landlords build Series LLCs with asset protection from day one.

📞 Book a strategy session here:

👉 https://mytxwills.com/book-a-meeting/

📜 Disclaimer

This content is for informational purposes only and does not constitute legal advice. Reading this blog does not create an attorney-client relationship with Mike Massey Law, PLLC.

Always consult with a licensed attorney before structuring a Series LLC. This is general information and should not be relied upon as advice.